The article below was published in The National List of Attorneys January 2011 Quarterly eNewsletter

Technology you need today!

By: Nick Machol, Jacques Machol and Kris Smith

I was reading the other day that toaster technology has not changed in the last fifty years. This seems like a paradox in a world where Moore’s law is king (which states that computing power doubles every two years). Our firm doesn’t own a single working piece of technology equipment that has been around for more than ten years. So, why is your parents’ 1953 Toastmaster 1B3 still popping out perfectly darkened toast while your two year-old $30,000 server is crashing every other week? The answer is simple: Bread is always the same, whereas your workflow is always changing.

The way in which we collect debt evolves every day. Having a debtor’s home phone number used to be some of the best information you could have. Now, over thirty percent of debtors don’t even have a landline; they depend solely on a cell phone.

The ever-changing workflow of a collection firm should dictate its technological needs. Unfortunately, collection firms typically do the reverse and allow their technological capabilities to dictate their workflow. Here’s an example: A firm employs a clerk to enter all Return of Service information into the computer system by hand. The process creates a bottleneck in the litigation workflow that limits the number of law suits processed each month. The manual process exists because the firm does not own a high-speed scanner with software that can read barcodes and automatically update files.

If you want to avoid bottlenecks, then evaluate your workflows and invest in technology. The following is a breakdown of technological advances you should implement to take ownership of your workflow.

Skip Trace Waterfall

Twenty percent of collector time is spent manually skip tracing. Collectors could be twenty-five percent more productive if manual skip tracing could be eliminated! Get rid of this inefficiency by creating a skip trace waterfall.

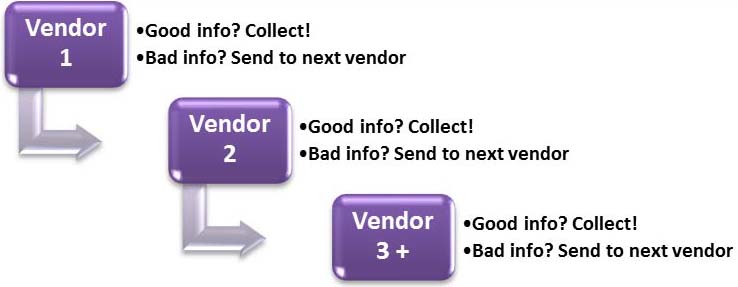

A skip trace waterfall is a program that sends batches of accounts to data vendors and populates your system with the data returned. Collectors use the data and tell the system if the information is good or bad. The system monitors “return on investment” and ranks the vendors in the waterfall. Accounts are first sent to the vendor that generates the most dollars in collections for each dollar spent on the information. All no-hits (or redundant hits) from the first vendor are sent to the next vendor in the waterfall. This process continues until good information is located (See Exhibit 1).

Exhibit 1

The key to creating an effective skip trace waterfall is spending time and money on good programming. The system must be capable of processing large volumes of data without creating exceptions. Similarly, the system must have built-in logic so that it does not make your firm spend lots of money skip tracing low-yield accounts.

Barcoding and High-Speed Scanning

Humans are mistake-making machines. “Fat-fingered” “Messed-up” “Mistyped” are all terms used when something is done wrong by a clerk that should have been done right. Take the responsibility of data entry out of human hands, and give it to a sophisticated computer system.

Here’s how you make the transition: First, print a file number barcode on every debtor-related document that leaves your office, especially demand letters and legal documents. Second, buy a high-speed scanner with software that can recognize barcodes and can interface with your collection software imaging system. When a stack of return mail is dropped on your clerk’s desk, he or she can run all of the barcoded letters through the high-speed scanner. Each letter will be scanned to the appropriate file, and the system will automatically notate in the file that the address is bad. In turn, your system knows that the address is bad, and you can rest assured that the file is properly notated.

Online Payment Options

You wouldn’t want to have to call your bank every time you make a mortgage or credit card payment. Similarly, your bank wouldn’t want you to call every time you make a payment. It costs you time to make the payment, and it costs the bank money to have a live person on the phone.

The same can be said for collection firms. Collectors need to spend their time convincing debtors to make a payment, not taking payments. Use a one-time payment website and a debt negotiator website to remove payment processing from your collector’s duties.

A one-time payment website is like the website you encounter when you pay your monthly credit card bill online. The website allows the debtor to access his or her account by entering the file number and last four digits of his or her social security number. The debtor’s account information is displayed, and the debtor can pay any amount desired. A debt negotiator website serves the same purpose except it can offer the debtor a payment plan using pre-programmed parameters.

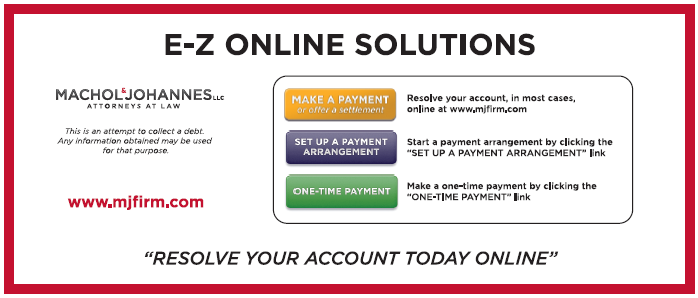

Remember that debtors aren’t going to find these tools by themselves. They need to be marketed in every piece of written and verbal correspondence that leaves your office. Include statement stuffers in outgoing mail (See Exhibit 2) and train your staff to promote the different online payment options. If well-executed, ten to twenty percent of your payment volume should be processed online.

Exhibit 2

SharePoint Calendar

Collection firms live and die by their legal calendars. As you add more claims and more attorneys, the calendaring process can become very complex. Instead of using a paralegal to enter upcoming court dates on a calendar, use Microsoft SharePoint to automatically create a calendar from the data stored in your collection system.

SharePoint allows you to easily share files and information throughout your firm. It displays data from a standard SQL database. Employ a programmer to create a process that pulls data from your collection system and places it in your SharePoint SQL database. The data can then be displayed on a shared SharePoint calendar for all attorneys and paralegals to see. With a little additional programming, you can even make the SharePoint calendar sync with your Microsoft Outlook calendar on your desktop and smartphone.

Call Recording

Thanks to a few bad apples, most consumers believe debt collectors are nasty people who are out to steal money from hard working Americans. This perception leads many consumers to believe they’ve been harassed by collectors, even when they haven’t! The best defense against these “he-said, she-said” allegations is to record every call to and from your office.

Call recording empowers you to fight back against allegations of harassment. Let debtors (and their attorneys) listen to the calls. This provides solid evidence that your collectors did nothing wrong. To the same end, just knowing the call is being recorded pushes your collectors to stay compliant.

Call recording is also a powerful training tool. Have listening sessions with your collectors and ask them what they did right and what they did wrong. Listen to exemplary calls and listen to sloppy calls. This tool helps them stay complaint and become better communicators.

Dialer Technology

The dialer is going the way of audio cassettes and VHS tapes. It used to be the pinnacle of collection technology, but is now nearly obsolete. A few years ago, the Federal Trade Commission dictated that cell phone numbers could no longer be included in dialer campaigns. Collectors are now limited to dialing “cell phone only” debtors by hand. The 2009 National Health Interview Survey found that nearly twenty-five percent of homes were “cell phone only.” Not only are dialers expensive to buy and expense to run, but they can’t be used to call one-fourth of your debtors.

Nevertheless, dialers are not totally impractical. The ability to make thousands of calls in an hour is valuable. That’s why you should use a hosted dialer. It is much cheaper than actually buying an in-house dialer. A hosted dialer is an Internet-based platform, managed by a third-party company. You send your accounts to the hosted dialer company and your collectors use the Internet to participate in the campaigns. A good hosted dialer company will even scrub debtor phone numbers to be certain that there are no cell phones in the mix.

Account Scoring

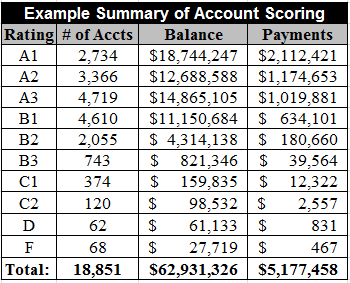

An internal study by a respected account scoring vendor showed us that ninety-four percent of our collections came from fifty-seven percent of our accounts. This means forty-three percent of our time was spent collecting six percent of our money. If we had only known which accounts would become “payers,” then we could have saved a ton of time and simply put minimal work into the “non-payer” accounts.

Account scoring is an external function. It is best outsourced to companies with troves of consumer data and Ph.D. statisticians on staff. These companies are able to tell you which debtors will pay and which will not pay (Exhibit 3). The debtor’s ability and willingness to pay is assigned a ranking which is loaded into your collection system. Assign the highest ranked accounts to your best collectors to maximize liquidation.

Exhibit 3

List of technology vendors mentioned in this article

Barcoding and Scanning:

One-Time Payment Processor:

Debt Negotiator:

Shared Calendar:

Call Recording:

Dialer Technology:

Account Scoring:

About the Authors:

Nick Machol, Director of Operations – Mr. Machol’s daily functions involve forecasting, financial analysis/reporting, and strategic development. Prior to joining Machol & Johannes, LLC, Mr. Machol was employed at Ernst & Young LLP, where he served in the Real Estate Assurance Group. He holds a Bachelor of Science degree in accounting as well as a Master’s of Accountancy degree from the University of Denver. He is a Certified Public Accountant in the State of Colorado.

Jacques A Machol III, Managing Attorney – Mr. Machol received his law degree from the University of Denver in 1977 and has been a member of the Colorado Bar since 1977. He frequently speaks to lawyers and creditor groups about collection matters and debt buying. Mr. Machol has extensive experience in purchasing and collecting purchased debt portfolios. In 2006, Machol & Johannes, P.C. merged with the national firm of Linebarger Goggan Blair & Sampson, LLP resulting in Mr. Machol becoming a capital partner member of the management committee of the firm. Mr. Machol and his law partner, Randall Johannes, repurchased the practice from Linebarger in early-2009. Since the repurchase, the firm has grown significantly.

Kris Smith, Director of Collections – Mr. Smith’s daily functions involve overseeing collection operations and collection strategy. He has worked in collection management for more than ten years. Prior to joining Machol & Johannes, LLC, Mr. Smith worked for a large national bank as well as a national collection agency. He holds a Bachelor of Science degree in finance from the University of Nebraska.